There’s no doubt that eSports are huge. What appeared to be a temporary solution at first quickly turned into an actual business vertical. Understanding its huge potential, betting companies directed resources and expertise towards the new area, with the objective of making the most of this opportunity and growing both their revenues and audience pools.

OddsMatrix is a sports and esports data API that covers live and pre-live odds for over 1000 esports competitions. In this article, we’ll offer you a deep dive into the esports industry and its interaction with betting.

The growth of esports is a topic that has made headlines in the past years.

The Newzoo global esports report issued in 2022, assessed, at the time, that the industry’s audience would reach 318 million people in 2025. Out of these, 261 million were expected to be esports enthusiasts – users who watch professional esports more than once per month.

According to the same study, “Digital and streaming are the two fastest-growing revenue streams for esports, with 2020-2025 CAGRs of +27.2% and +24.8%, respectively.” In terms of revenue, the market is projected to reach $4.3 billion in 2024.

The United States generates the most revenue in the Esports market, with a projected market volume of US$1,070.0m in 2024.

Covering a huge chunk of the esports tournaments and leagues, OddsMatrix Esports Data APIs is a great solution for sports and esports betting providers to build their business with the most reliable and accurate data.

There is a complex landscape responsible for esports growth, which involves different types of stakeholders.

It all starts with the game publishers, the companies that create (either in house or by working with outside talent) and deploy the games, managing operations, updates and new feature releases. They target consumers and players, but, in order to reach those, they need to make their products known.

To drive awareness and engagement, publishers work with tournament organizers, broadcasting companies that live stream events, pro players and influencers. This is how they generate interest and word-of-mouth around their games.

This whole ecosystem is fostered by financial resources, which are supplied by sponsors. Usually, these are brands that gain value by associating their images with online games and which create in-game activations to engage fans.

The dynamic landscape quickly created a path for betting agencies and esports bettors alike, which identified a promising niche. The increased viewer interest in esports statistics and strategies has subsequently led to a significant increase in esports betting.

International players populate the global esports market, attracting interest from hundreds of millions of fans.

The rise of esports brought with it a wide pool of dedicated events and tournaments where teams compete against one another for impressive prizes. Similar to sporting events, tournaments contribute to esports growth through media rights, sponsorships, vendor sales, ticket fees, royalties, and, of course, betting.

This financial ecosystem enables organizers to offer impressive prizes which often make headlines. The size of events, as well as the teams and players taking part in them, encourage esports enthusiasts to engage in betting activities.

OddsMatrix supports your betting activities covering real-time pre-live and live odds for a wide range of esports titles, such as FIFA, NBA2k, LOL, Dota 2, CS:GO.

The in-house team prevents fraud by monitoring markets and odds 24/7 and cross-checking info for accuracy. Moreover, the platform offers rapid and correct final results for all esports included in its portfolio.

EA is known as the pioneer of home computer games and, currently, one of the world’s video gaming giants. The company, which is headquartered in California, and has offices around the world is known for legendary franchises, like FIFA, Madden NFL and the Sims.

The company has generated $7.426B in net revenue in 2023.

Its soccer product, FC, is, as Statista shows, one of the best selling video games, capturing audiences worldwide. Even after the rebrand, FC beat expectations.

Before the pandemic and massive rise in esports, the traditional 2018 FIFA World Cup had a betting turnover assessed at Euro 136 billion, according to an analysis carried out by FIFA and Sportradar. The average match generated Euro 2.1 billion in bets, while the final between Croatia and France drove an impressive Euro 7.2 billion in worldwide betting turnover.

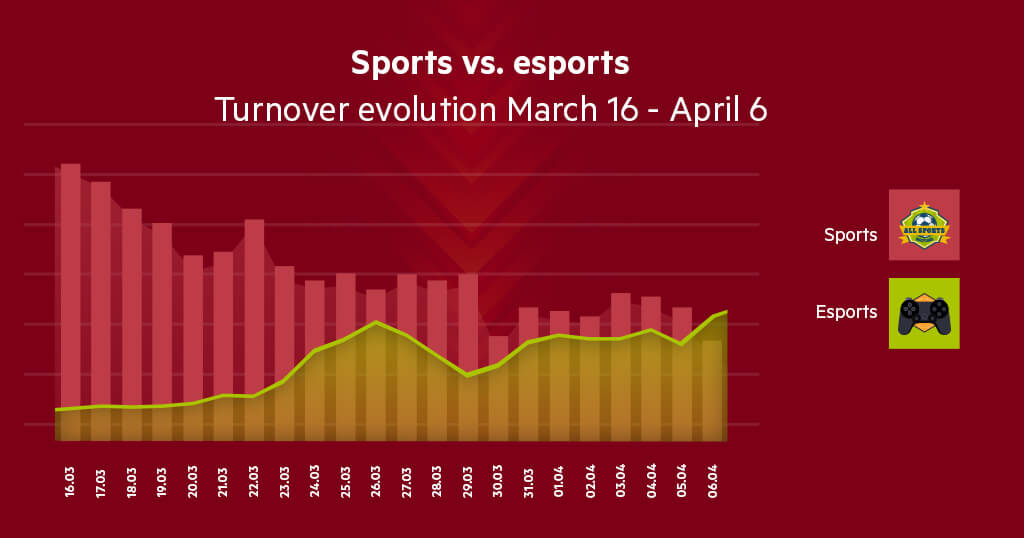

OddsMatrix State of Esports Report 2020 Sports vs esports turnover March-April 2020

As the third-largest publicly listed company in the U.S. and Europe, Take-Two Interactive is an important player in the industry. The company closed FY2023 with $5.35B, a 52.64% increase from 2022.

Some of the most popular names in the company’s portfolio include franchises like NBA2k, Grand Theft Auto, BioShock, Red Dead or Borderlands.

The NBA2k League is proof of the huge potential that esports has in attracting mainstream audiences. The 2023 event was broadcast on ESPN 2 and ESPN’s digital platforms, on Canada’s Sportsnet in Canada, Southeast Asia’s eGG Network, and India’s Loco.

With so many international viewers following it, the esports event also generated enthusiasm from worldwide bettors.

Push NBA2k odds and scores updates in real-time or pull NBA2k data you need in your betting application and engage bettors with OddsMatrix.

The world’s biggest video game publisher is Tencent, the Chinese organization which registered nearly $25 billion in revenue in 2023.

The Tencent group owns Riot Games, creator of free-to-play titles like League of Legends, the multiplayer online battle arena (MOBA) game, and VALORANT, the first-person hero shooter. These are some of the most powerful brands in esports and in esports betting.

With over 180 million active players worldwide and more than 12 leagues which last for about 7 months/year, League of Legends is a strong brand for professional tournaments. The most successful of them is the League of Legends World Championship or Worlds, which brings together the world’s top 24 teams that compete, for 4-6 weeks, for millions of US dollars in prize pools.

With OddsMatrix, bookmakers have access to live and pre-live odds for some of the world’s S-tier LOL tournaments.

These tournaments have outstanding prize pools of millions of US Dollars and bring together the most reputable players.

Check OddsMatrix LOL Data Feed coverage.

Since its release in June 2020, VALORANT sparked much enthusiasm, thus leading to a high number of tournaments popping up across the world. Still, the most popular is the VALORANT Champions Tour, which lasts for a whole year and features the world’s best players. In 2024 the tournament had a pool prize of $2million.

Being part of the event is the highest goal a team could have, because of its prestige, while winning is the utmost recognition. VCT is extremely popular among bettors and has been listed on numerous betting sites starting in 2021.

OddsMatrix covers over 50 VALORANT tournaments, including the VCT, for which we cover pre-live and live odds.

Tencent is also a minority shareholder in other video game companies, like the American Epic Games, Activision Blizzard, South Korean Krafton Game Union, and French-native Ubisoft, which means the company is bound to generate even more revenue from esports and foster the esports betting market.

Activision Blizzard was formed in 2008, through the merger of two American game companies, Activision and Blizzard Entertainment. The California-based studio is known for its worldwide appreciated games, like the iconic Call of Duty and the World of Warcraft series.

In 2022, the latest year with available data, the organization generated over $7 billion, thus contributing to the overall esports industry growth. In January 2022, Microsoft announced it will buy Activision Blizzard in an all-cash transaction valued at $68.7 billion, which was closed in 2023.

CS:GO is extremely popular as an esport. Players across the globe want to compete with one another during important, prestigious leagues and tournaments.

The 2024 Call of Duty league season brought together 49 players and a $3.500.000 prize pool.

One of the esports events with the longest history appears to be The Arena World Championship (AWC), which reached its 17th edition in 2024. The total prize was $300.000.

Bettors from North America, Europe, Latin America, Asia and India followed the event, trying to generate their own revenues, by identifying the winners. This huge, diverse audience meant the betting market was extremely high for this particular event.

Other highly regarded CS:GO tournaments added to betting offers are: Republeague or Elisa Invitational.

Here you can find an exhaustive list of pre-live and live odds covering over 400 CS:GO Leagues and Tournaments.

The top 10 Esports by peak concurrent viewers in 2025 are:

| Rank | Game | Peak Viewers | Hours Watched | |||

| 1 | Mobile Legends: Bang Bang | 2,769,107 | 88.6M | |||

| 2 | League of Legends | 1,907,634 | 114.3M | |||

| 3 | Valorant | 1,319,067 | 82.9M | |||

| 4 | Counter-Strike 2 | 1,299,747 | 100.9M | |||

| 5 | PUBG Mobile | 697,213 | 38.2M | |||

| 6 | Dota 2 | 678,543 | 42.5M | |||

| 7 | Free Fire | 626,345 | 25.7M | |||

| 8 | Arena of Valor | 545,099 | 20.4M | |||

| 9 | Call of Duty: Warzone | 514,889 | 18.3M | |||

| 10 | Apex Legends | 492,001 | 27.9M |

This table ranks the top esports titles of 2025 based on peak concurrent viewership, which indicates the highest number of simultaneous viewers during a single event broadcast. Mobile Legends: Bang Bang leads the chart with nearly 2.8 million peak viewers at its M6 World Championship, a reflection of its massive popularity in Southeast Asia and among mobile-first audiences. League of Legends follows with close to 1.9 million during Worlds 2024, maintaining its longstanding dominance in the global PC esports ecosystem. Other strong performers include Valorant and Counter-Strike 2, both of which drew over 1.3 million viewers at their marquee events.

Interestingly, mobile games dominate several top spots (MLBB, PUBG Mobile, Free Fire, Arena of Valor), highlighting the rise of mobile esports, particularly in Asia. Languages such as Indonesian, Vietnamese, and Russian are prominent, suggesting a broad and multilingual global viewer base.

According to Escharts, the biggest eSports organizations as of 2025 are:

| Organization | Active Rosters | Former Rosters | Prizes Earned | Streamers | Players | Tournaments |

| Team Falcons | 30 | 3 | $8,729,878 | 58 | 148 | 615 |

| Team Liquid | 7 | 28 | $54,522,884 | 172 | 128 | 2079 |

| Twisted Minds | 28 | 4 | $2,125,402 | 20 | 128 | 689 |

| Weibo Gaming | 17 | 1 | $7,052,979 | 0 | 117 | 159 |

| Bigetron Esports | 21 | 10 | $1,185,592 | 0 | 89 | 260 |

| Ninjas in Pyjamas | 14 | 5 | $8,945,031 | 16 | 89 | 538 |

| Gen.G Esports | 22 | 9 | $10,695,083 | 34 | 88 | 371 |

| Nova Esports | 18 | 13 | $9,755,650 | 12 | 85 | 124 |

| ONIC Esports | 15 | 6 | $2,290,946 | 0 | 82 | 175 |

| Rex Regum Qeon | 22 | 10 | $2,896,657 | 0 | 81 | 262 |

| Natus Vincere | 14 | 18 | $23,702,515 | 69 | 81 | 941 |

| Virtus.pro | 21 | 11 | $20,849,113 | 59 | 76 | 536 |

| Team Vitality | 16 | 14 | $10,745,186 | 25 | 74 | 542 |

| Al Qadsiah | 13 | 0 | $50,668 | 0 | 72 | 24 |

| Talon Esports | 13 | 5 | $4,772,083 | 4 | 71 | 314 |

| Team Flash | 12 | 3 | $1,059,228 | 2 | 70 | 152 |

| Corinthians | 8 | 5 | $136,954 | 0 | 67 | 174 |

| Dewa United | 12 | 3 | $114,565 | 0 | 67 | 137 |

| Malvinas Gaming | 6 | 4 | $64,500 | 6 | 63 | 77 |

| Luminosity Gaming | 15 | 16 | $5,838,073 | 48 | 61 | 454 |

Team Liquid stands out dramatically with over $54 million in prize earnings, supported by vast infrastructure—28 former rosters, 128 players, and involvement in over 2,000 tournaments. Other giants like Natus Vincere, Virtus.pro, and Gen.G Esports also boast impressive earnings and active tournament rosters, showing longevity and impact across multiple titles. Meanwhile, rising stars like Team Falcons and Twisted Minds show significant activity and competitive growth, especially in emerging mobile or regional esports markets.

On the other hand, several teams—including Malvinas Gaming, Al Qadsiah, and Dewa United—reflect more modest figures in terms of prize money and roster volume. Their lower tournament count and relatively small player bases may indicate newer or more regionally-focused operations. Collectively, the table underscores how elite-level success and global engagement (reflected in prize pools and participation) vary widely across the esports ecosystem, with some teams targeting depth in one game and others expanding across multiple scenes and continents.

Here are the latest Esports team statistics:

| Team Name | Prize Money Earned | Team Tournaments | Peak Viewers | Matches |

| Corinthians | $60,759 | 88 | 751,237 | 2K |

| Fluxo Gaming | $529,207 | 97 | 471,483 | 2K |

| FAZ O P | $34,977 | 74 | 340,521 | 2K |

| LOUD | $534,876 | 71 | 570,515 | 2K |

| Antisocial Team | $8,672 | 108 | 340,521 | 1K |

| BOOM Esports | $271,685 | 46 | 566,118 | 1K |

| paiN Gaming | $86,947 | 84 | 751,237 | 1K |

| AJF E-SPORTS | $19,074 | 56 | 340,521 | 1K |

| DRS GAMING | $719,527 | 77 | 851,780 | 1K |

| Flamengo MDL | $60,209 | 85 | 340,521 | 1K |

| Los Grandes | $12,110 | 57 | 299,877 | 1K |

| FaZe Clan | $378,052 | 47 | 980,123 | 1K |

| Vivo Keyd Stars | $502,129 | 39 | 354,836 | 880 |

| Bigetron Esports | $1,167,687 | 38 | 525,096 | 862 |

| Team Queso | $236,465 | 34 | 825,830 | 853 |

| D’Xavier | $724,294 | 55 | 980,123 | 849 |

| FUT Esports | $332,189 | 31 | 235,711 | 848 |

| Team Liquid | $31,780,288 | 116 | 1,965,328 | 819 |

| Team Secret | $379,413 | 42 | 646,633 | 807 |

| 4Merical Vibes | $467,473 | 47 | 985,418 | 775 |

The data above provides a snapshot of esports teams spanning primarily mobile titles like Free Fire and PUBG Mobile, as well as a few PC-based giants such as Team Liquid. A key trend is the relatively modest prize earnings of Free Fire-dominant teams such as Corinthians, Fluxo Gaming, and LOUD, all of which participate in a large number of tournaments and matches with peak viewership reaching hundreds of thousands, yet earning under $600,000 in prize money. These teams thrive on regional popularity and viewer engagement, especially in South America and Southeast Asia, but they participate in scenes with smaller prize pools compared to tier-one PC esports.

In contrast, organizations like Team Liquid, Bigetron Esports, and 4Merical Vibes operate in higher-stakes environments such as Dota 2 and PUBG Mobile’s international circuit. Team Liquid stands out as a behemoth, boasting over $31 million in prize earnings, the highest on the list by far, with close to 2 million peak viewers and a vast tournament history. These discrepancies highlight the divide between teams capitalizing on localized mobile market dominance and those entrenched in global PC competitions with more lucrative rewards.

According to EsportsEarnings, the top 10 players by total wins are:

Notably, all top 10 players have earned the majority of their prize money through Dota 2 tournaments. The highest-earning player outside of Dota 2 is Kyle “Bugha” Giersdorf from the United States, who ranks 22nd with $3,744,925.05 earned primarily from Fortnite competitions.

As of early 2025, the top earners in CS2 include:

Note: These figures are approximations based on available data up to early 2025.

Dota 2 remains the most lucrative esports title, with top players earning millions:

Fortnite’s top earners have amassed significant winnings from major tournaments:

League of Legends players have earned substantial amounts through consistent performances:

Apex Legends has seen its top players earn impressive sums from competitive play:

Valorant’s competitive scene has produced several high-earning players:

Rainbow Six Siege players have earned significant amounts through major tournaments:

OddsMatrix offers bookmakers the best coverage in the industry, with the world’s most engaging esports markets. The solution focuses both on sport-simulated games, like FIFA and NBA2k, as well as on classic esports, like CS:GO and DOTA 2.

Depending on your needs and your platform’s structure, the service may be used as a feed solution or as a hosted solution with a dedicated front-end that is tailored specifically for esports.

What makes OddsMatrix an industry leader is the fact that it continuously adds new esports and betting markets, as well as its full range of benefits. From real-time betting odds, stats, scores and settlements, to fully automated trading. We give you the option to tweak odds and customize profit margins, offering bookmakers a wide selection of valuable features that are meant to make a difference.

Moreover, the OddsMatrix Esports Data APIs offer betting applications access to pre-live and live odds for some of the most popular esports events in the world, created around games like FIFA, NBA2k, VALORANT, LoL and CS:GO.

Partner with us and get the most accurate pre-live and live odds for over 500,000 esports events/year for your sportsbook or betting application.